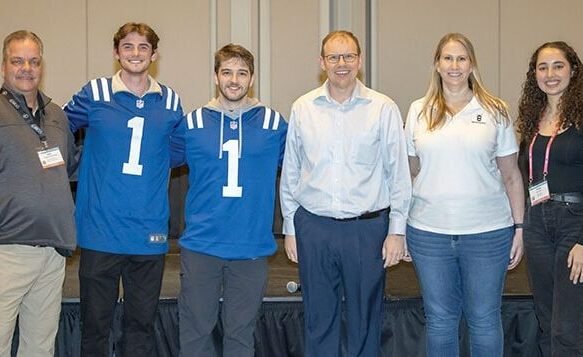

When I stepped into the ring at “ROCKY: Going One More Round with Digital Parking,” at PIE 2023, I was primed for some friendly competition. I had been invited to duke it out as a panelist on the topic of the state of digital parking. The pressure was on.

Along with David Hoyt from ParkMobile, I fired off answers to hard-hitting questions before an at-capacity crowd. In case you missed the fun, or just want a quick refresher, here’s a recap of the Qs, the As, and the top four takeaways.

Q: Mobile payments haven’t penetrated all parking transactions. What are the holdouts?

A: It’s simple: Not everyone wants to download an app. If the value from the app outweighs the effort—taking the time to download, sign up and register—then sure, the driver will use it. But that’s not always the case. One-time parkers in particular see no value in mobile apps.

With holdouts in mind, we need to get to a place where digital payments are no longer competing exclusively within the app market, but are going head-to-head with traditional hardware. Instead of downloads, the goal should be to meet the customer exactly where they want to transact virtually. Do they need an account? Or do they need an expedited, guest checkout payment experience?

Takeaway 1: It’s time to shift the digital payments narrative from exclusively apps, to software versus hardware.

Q: Does network size matter in the world of digital payments?

A: Not always. Just a few years back, network size was a key factor in the digital payment space, but the landscape has changed. Early on, mobile payments were exclusively app-based and as a result, their success was dependent on market supply. When a driver uses an app, the experience will only be positive if there are enough nearby parking spots or locations.

These days, the size of market penetration only matters for the mobile app to work. As QR codes become more prevalent as a mode of payment, the landscape of everyday transactions – parking included – is rapidly changing towards no-app digital payments. And it’s not slowing down anytime soon, QR code payment users are forecasted to exceed 2.2 billion by 2025.

With no-app mobile guest checkout on the scene, network size becomes irrelevant. Why? Because unlike an app, this new form of digital payment creates a virtual point of sale—like a parking meter on your phone—rather than a marketplace reliant on inventory.

Takeaway 2: Network size means nothing when the phone is the virtual point of sale.

Q: What’s next in parking innovation?

A: There’s innovation in all areas of the parking ecosystem but let’s face it, we all just want an easy and secure way to pay and get paid. Everything boils down to a single question: How can we make the payment transaction as simple as possible for everyone involved?

With the ease of single click-to-buy, mobile payment use is skyrocketing. A recent survey found that 57 percent of consumers prefer mobile payment methods over traditional ones because they are faster and more convenient. In 2023 alone, 1.6 billion global consumers are forecasted to pay via digital wallet and mobile use is expected to hit $930 billion by 2025.

Innovation is constantly sparking on the operator side, too, as collection becomes more streamlined. Operators can log into their accounts to quickly access real-time data and create and adjust rates and promo codes in response to changing circumstances.

And remember, there is always innovation on the horizon as new developments gain traction. We still haven’t cracked the code on making the parking experience in gated facilities less burdensome, for example. And with the electric vehicle market starting to boom, we’ll need to think about integrating frictionless EV parking and mobility solutions.

Takeaway 3: Innovation ultimately comes down to making it easier for drivers to pay, and operators to get paid.

Q: Why should a customer choose a company of your size?

A: Ahhh, time for a shameless plug. At HONK, we’re a small but mighty hands-on team that really cares about the customer experience. In fact, we consider our size our superpower.

It takes having all ears on the pavement to get to know customers’ needs and preferences and to be able to meet them by quickly pushing out new products and features. Plus, we’ve got a killer tech stack powering our operations – we are the inventors of parking’s no-app mobile guest checkout, after all.

We believe in what the stats tell us: Businesses that accept digital payments are reported to see a 25 percent jump in sales, which is attributed to the ease and speed of transactions. So, it’s a good thing we identify as a payments company first, as payments are a fundamental part of our DNA. After all, our founder has been in the payments industry for 20-plus years.

For us, customer success is the ultimate prize. At the end of the day, it’s what keeps all of us on our toes in the ring!

Takeaway 4: We’re a small and mighty team so we can move fast and innovate!

Kacey Siskind is a founding member and Senior Vice President at HONK, a provider of contactless payments for parking and mobility. She leads new business opportunities to scale the company’s expansion in the U.S., Canada and emerging markets. She can be reached at kacey@honkmobile.com.