Cities are looking for money. And where else but that traditional cash cow, parking. It’s simple: Just tax parking receipts and collect millions.

Not so fast, some parking operators say. Believing these taxes would have a detrimental effect on their industry, they are beginning to push back.

“We simply can’t stand aside and allow taxes on parking (receipts) to increase,” said Tim Leonoudakis, President of City Park in San Francisco. “The increase affects not only our business, but also the health of the entire downtown business core.”

Leonoudakis was part of a group that stopped the doubling of the parking tax in San Francisco in 2006. “It wasn’t something done lightly,” he said. “We took on the city, and won.”

As Leonoudakis tells it, word came down back then that the San Francisco Board of Supervisors was putting the tax increase on the ballot just 90 days before the election. It was called Proposition E.

The local parking companies founded an association for the express purpose of defeating Prop. E. They hired a lobbyist, put together a budget that exceeded $350,000, and started to work.

“There are a lot of stakeholders in this process,” Leonoudakis said, “including all real estate developers, the chamber of commerce, business associations, and virtually all unions. Each one has a vested interest in keeping business moving in the city.”

Typically, business and unions are on opposite sides of an issue. However, in this case, each saw that the reduction of traffic in the downtown area, the threat of business moving out of the city, people making choices to work and play in other areas were a direct threat to all their livelihoods.

“We went to organizations, individuals and unions and asked for donations,” Leonoudakis said. “It didn’t take long to meet the budget. It was a grass-roots campaign. We told the people of San Francisco that the city was raising their taxes in a time when we couldn’t afford it.

“The single most expensive part of the project was the television campaign. We went on the local cable stations. The production and ad buys cost $150,000.

“We stressed that the new taxes were bad for business, bad for merchants, and would be killing the downtown,” he said.

Members of the group met with the editorial boards of the local newspapers and got all of them on their side. They were able to convince the mayor and some members of the board of supervisors that the tax increase was a bad idea.

“Look,” said Leonoudakis, “we knew the city needed money. We just didn’t want them to take it in this way. So we gave the politicians other ideas for revenue generation, including better enforcement of existing parking revenue taxes and the increasing of on-street parking fees to market rates. We mentioned gasoline taxes.”

In fact, the city of San Francisco has begun an extensive program to set on-street parking rates using a market-based model. The “SF Park” program, one of the most widespread in the country, is just now going into effect. The program has some of its roots in that 2006 campaign by local parking interests.

“We held weekly meetings, ran two polls – which by the way are very expensive – had our employees wearing “No on E’ T-shirts the last week before the election, and we placed door hangers throughout the city.

“We won by a landslide, a 67% majority,” Leonoudakis said.

One of the main issues, he said, was the fact that the city has great difficulty in collecting existing parking taxes. There is a 10% tax in San Francisco, and a number of so-called fly-by-night parking operators under-report their parking income, thus not paying their full share of taxes.

The group in San Francisco volunteered to help the city collect those taxes and train city auditors in how to ensure that all the revenue was reported.

It also recommended a city ordinance that made property owners responsible for taxes if their operators didn’t properly report and collect them.

“The city is looking for revenue,” Leonoudakis said. “It should properly collect the revenue currently due it, before increasing taxes that hurt legitimate business. An offshoot of the campaign to stop Prop. E was a leveling of the playing field in the city, ensuring that all operators paid the taxes due.

“The city has not come back and tried to increase parking taxes,” Leonoudakis said. “They know we are organized, know what we are doing, and will fight back.”

Other cities are looking strongly at parking tax hikes as a way to increase their revenue, and local groups are forming in opposition. Meetings have been held, as recently as late April in Los Angeles, to fight tax increases.

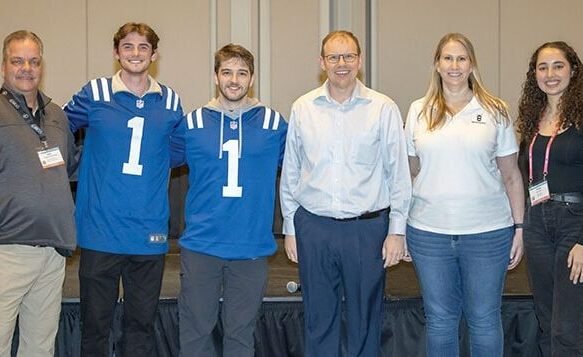

Leonoudakis, Rob Zuritsky of Parkway and Roy Carter of Toledo Ticket are championing a program, with the National Parking Association (NPA), to let parking companies across the country know just how the San Francisco group successfully beat back the tax increase.

Also, a page will be up shortly at the NPA website (www.npapark.com) that will provide tools that can be used to fight parking tax increases.